In the networking space, it’s almost impossible these days to open a browser without seeing something about disaggregation. It’s the technology trend on everyone’s mind. Which makes sense—some revolutionary innovations are happening in this space. Where people get confused, however, is when the conversation turns to what disaggregation means for longstanding network vendors like Juniper Networks. Take a look at some of the opinions and public comments in these conversations and it’s easy to think network vendors are disaggregation’s biggest adversaries, but that couldn’t be farther from the truth.

Let’s set the record straight: Juniper has not only advocated disaggregation to solve certain types of problems, we’ve led the industry for years in delivering disaggregated solutions, particularly for hyperscale cloud providers. Where we press the pause button, however, is when it comes to adopting new technologies for technology’s sake. This is especially important for service providers who (like others) are looking to reduce operational costs and complexity, not add to them.

Customers who run large-scale networks with Juniper aren’t particularly interested in speculative technology science projects. They just want to know if disaggregation will help them reduce costs, increase agility and eliminate vendor lock-in, while improving network reliability and simplifying the operator and end-user experience – and ultimately, if it will help them make money. In some cases, the answers are yes. In others, no. And that’s OK; any architectural discussion should start with the problem at hand and flow from there, not the other way around. When technology decisions are driven by customer or business outcomes, finding the right tool for the job is easy—and there isn’t another company better positioned than Juniper to help them do it.

In this first of a multi-part blog series on the topic, let’s take a closer look at disaggregation: what it is, why service providers are considering it and how cloud providers can tell when it’s the right choice for their business.

What exactly is disaggregation?

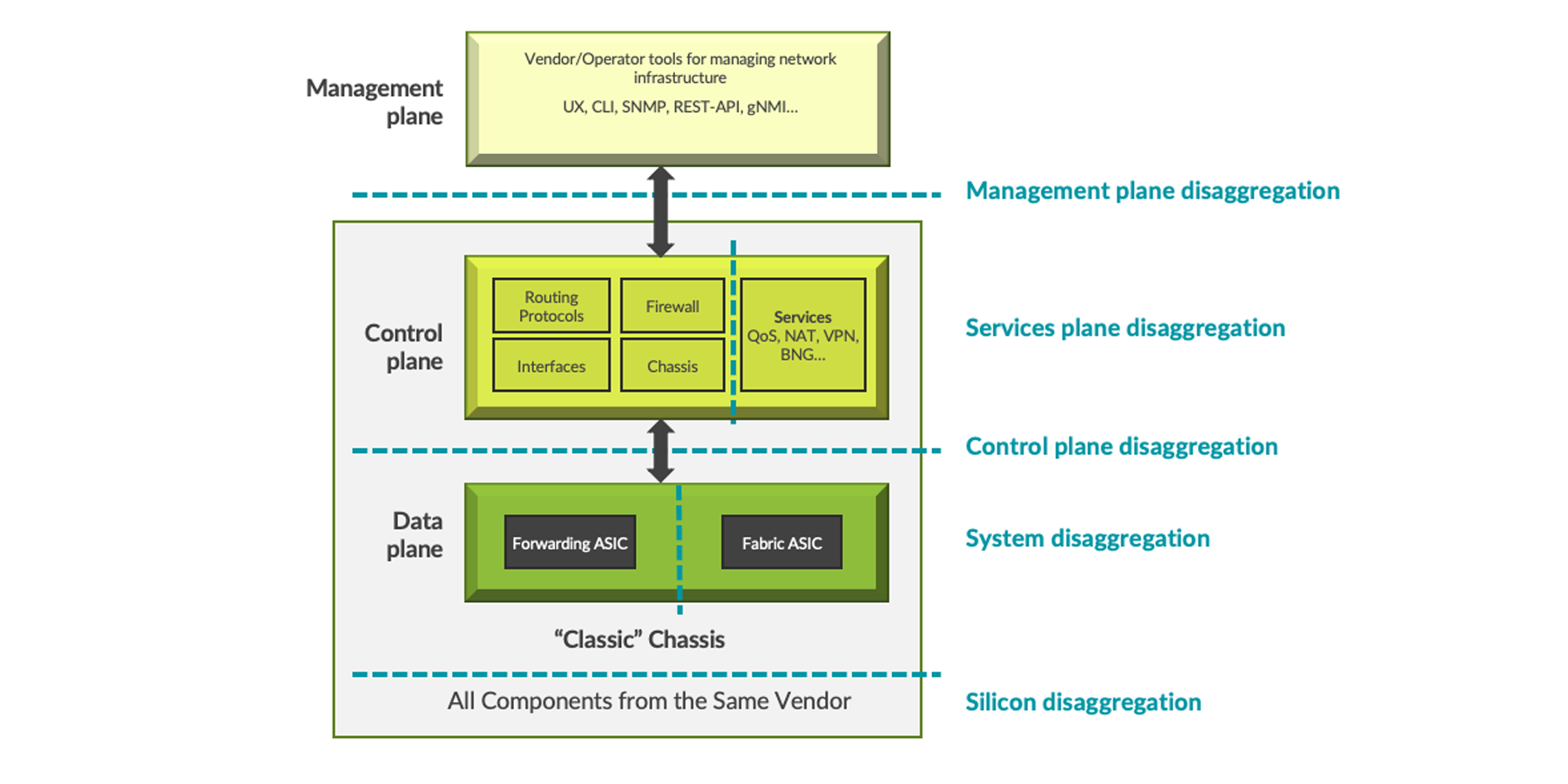

The question seems simple, but answers get surprisingly complex. Indeed, the wide range of approaches that fall under the term “disaggregation” can contribute to a lot of the confusion out there. In the marketplace today, there are five major types of disaggregation:

- Management plane disaggregation: using cloud-based tools to manage distributed infrastructure.

- Services plane disaggregation: splitting off specific services, such as running broadband network gateway (BNG) control plane in the cloud, in a Control Plane-User Plane Separation (CUPS) architecture.

- Control plane disaggregation: including software (or vertical) disaggregation, which can entail running one vendor’s network software on “white box” or merchant-based hardware or even breaking up the software itself into piece-parts that plug and play with other third-party network software.

- System disaggregation: such as hardware (or horizontal) disaggregation which breaks down a traditional multi-line card chassis into multiple smaller, fixed platforms, often in a scale-out architecture.

- Silicon disaggregation: where customers buy a routing chipset and build their own system around it.

These disaggregation types will be discussed in the next blog in this series. For now, the key takeaway is simply that disaggregation is not new. This trend has been evolving for a long time, in multiple directions, with different types of disaggregation geared to solve different problems. And future blogs will discuss how Juniper delivers cutting-edge disaggregation solutions using these approaches for service providers, enterprises and cloud providers alike.

Why disaggregate, anyway?

The recent focus on disaggregation in the service provider space stems from the very real challenges that modern operators need to solve. These include the usual suspects: rising customer expectations, exploding traffic volumes, competition with cloud providers and escalating complexity. To stay competitive, operators must invest in innovation, whether that’s 5G rollouts, expanding cloud and edge capabilities, virtualizing network functions or all the above. And with revenues largely flat, they must explore every possible opportunity to reduce capital and operational costs (CapEx and OpEx). So, will disaggregation help do this? There’s only one right answer: it depends.

For example, one of the trends gaining a lot of attention over the last few years revolves around using white box routing platforms and/or open-source network operating system (NOS) software. In theory, the ability to run networking software on a third-party vendor’s off-the-shelf hardware should lead to lower CapEx and reduced vendor lock-in, just like we’ve seen in the server marketplace. In practice though, the cost/benefit analysis gets much more complicated.

Yes, white box hardware can have a lower sticker price than an incumbent vendor’s pre-integrated routing platform (but even here, that gap is closing). But significantly more investment goes into building a carrier-grade network than buying a box. Indeed, hardware alone makes up only a small part of the deployment cost – there’s solution validation and homologation, software integration and revision management, maintenance and support, etc. The cost of running a network (OpEx) is vastly larger than the initial CapEx outlay and even with disaggregated solutions, this OpEx/CapEx gap is still greater.

With a routing platform from Juniper, that hardware is not only pre-integrated with the same consistent Junos software used everywhere else in the network. It’s pretested and validated for interoperability, security, resiliency and performance in the largest, most demanding carrier environments in the world. With a white box, all of the integration and testing is left for the customer to do themselves. It’s a massive DIY project—like assembling a car from a thousand pieces in the garage versus buying one from a car manufacturer.

Yes, that effort can make sense in certain circumstances. For example, radio access networks (RAN) have historically been dominated by only two or three major vendors. With competitive pressures blunted, substantial equipment-price declines experienced in other parts of the network have not necessarily occurred in the RAN. And with 5G deployments that feature tens of thousands of small cells with relatively low throughput requirements, the economics can be different. As a result, we’ve seen significant activity from new vendors working with operators on disaggregated open RAN initiatives.

In other parts of the network, the total cost of ownership (TCO) will be far lower—according to a recent Analysys Mason study, 40% lower—when customers don’t take on all the sourcing, testing and integration tasks that network vendors typically handle on their behalf.

Building the Disaggregated Solutions of Tomorrow

Juniper believes disaggregation can play an important role in solving some of our customers’ most pressing technical and business challenges. That’s why we’re developing a range of disaggregated solutions, from scale-out fabrics to Junos on Broadcom-based hardware to BNG CUPS and more – and these will be explored in upcoming blogs. Disaggregation is just one of several future-focused innovation areas we’re investing in.

Regardless of the goal—lowering costs, improving reliability, opening the network up to new vendors, moving to merchant silicon—there’s a Juniper solution to help. And when disaggregation makes sense, Juniper will help them adopt it—with minimal complexity and risk and the field-proven maturity that’s made Juniper a leader in service provider networking for 20+ years.

Stay tuned for the next blog in this series, where we’ll dive deeper into the different types of disaggregation.