Trust is at the heart of what holds the global financial system together. The value of trust is most evident with central banks. A loss of trust in a central bank has the potential to ripple through an entire economy, leading to a national or worldwide crisis.

The importance of central banks to the global economy cannot be overstated. They are the cornerstone of financial stability. They ensure liquidity, shape monetary policy, and maintain public confidence in the financial system. Society must trust that central banks can safeguard both the value of their currency and the underlying financial infrastructure they represent.

Given the importance of trust, it is imperative that central banks adopt technologies that are guaranteed to safeguard their communications and transactions against any potential security breaches. In an era of increasingly sophisticated cybercrime and AI-driven attacks, central banks are now responsible for protecting themselves and their clients from present danger and from threats that haven’t yet fully manifested. These future threats include “harvest now, decrypt later” attacks which rely on the arrival of a quantum computer powerful enough to decrypt today’s asymmetric VPN algorithms.

At the recent G7 quantum-safe workshop in Rome, Juniper Networks worked with our partners to demonstrate how quantum-safe networks can enable the stability and trustworthiness of financial systems in the face of today’s cybersecurity attacks—and the more serious quantum threats of tomorrow.

Organized by the Bank of Italy, the G7 Workshop titled “Building a Quantum-Safe Financial System: What Role for Authorities and for the Private Sector?” gathered financial authorities, technologists, and thought leaders from around the world. Together they addressed one of the most pressing challenges for our financial system: how to secure financial data against the potential power of quantum computing.

Quantum computers, once fully realized, could break the encryption methods currently protecting our sensitive information, rendering critical financial systems vulnerable. This is why proactive measures are essential to keep this data secure.

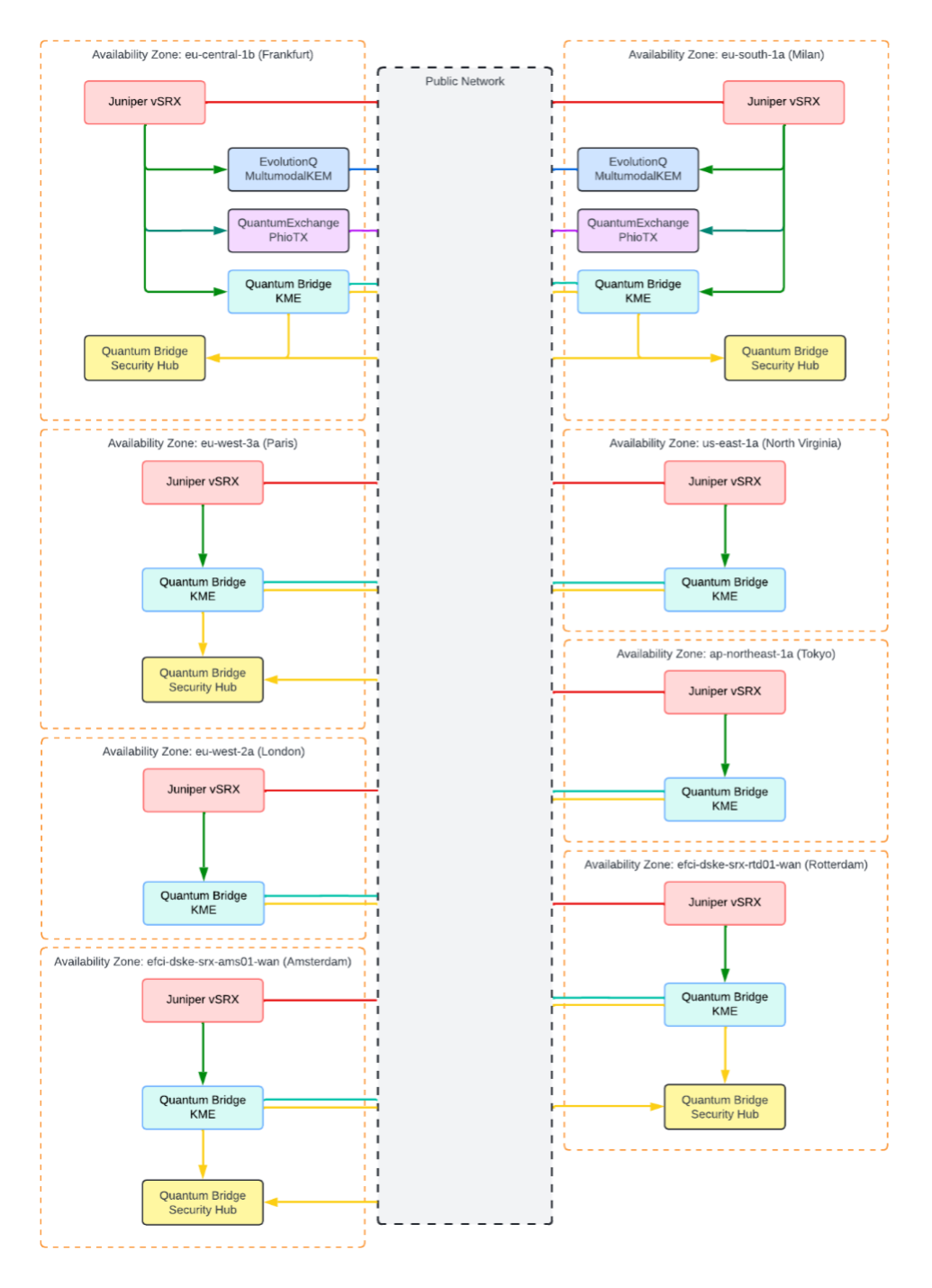

During the workshop, Juniper Networks’ quantum-safe solutions, featuring Juniper Networks® vSRX Virtual Firewalls, demonstrated how central banks can build quantum-safe networks. Leveraging Post-Quantum Cryptography (PQC) and symmetric key establishment solutions, we demonstrated how injecting additional key material into current cryptographic protocols can make them quantum-safe.

For these solutions, we collaborated with our technical alliance partners Quantum Bridge, Quantum Xchange, evolutionQ, and data center and connectivity services provider, Eurofiber. Our approach helps to ensure that networks can be secured against quantum threats today by providing quantum-safe IPsec and MACsec connections.

The quantum-safe key material, integrated via the RFC8784 IPsec extension, from Quantum Bridge, Quantum Xchange, and evolutionQ, lets the Juniper Networks® SRX and vSRX Series Firewalls help central banks create inter-bank communication networks that are both quantum-resistant and compliant with emerging standards and legislation.

This layered key structure aligns with current encryption requirements, minimizing the operational impact while extending protection across financial systems.

One of the major concerns that quantum-safe technologies aim to address is the “harvest now, decrypt later” attack. In this scenario, malicious actors store stolen, encrypted data, intending to decrypt it once quantum computers become sufficiently powerful to do so. Such attacks pose a direct threat to the integrity of financial transactions and communications, especially within the inter-bank space.

Our joint solution demonstrates how the combination of state-of-the-art firewalls with quantum-safe key management methods can mitigate these risks, providing robust defense even before quantum computers become an immediate threat.

What is particularly encouraging from the G7 Workshop is learning that CSfC compliant solutions to these quantum threats are already available today. By deploying quantum-safe technologies including IPsec in combination with RFC8784 and leveraging Symmetric Key Establishment, central banks and financial institutions can achieve compliance with guidelines from authoritative bodies like BSI, NIST, and AIVD. These solutions not only mitigate risk but also enable adherence to emerging regulations and best practices aimed at fortifying financial systems against advanced cyber threats.

Additionally, quantum-safe IPsec and MACsec provide a tangible path forward for central banks looking to reinforce the security of their inter-bank networks today, well ahead of the quantum future. The involvement of Juniper Networks, alongside innovative partners like Quantum Bridge, Quantum Xchange, evolutionQ, and Eurofiber, highlights how public-private collaboration can bring practical solutions to market.

In a world where trust is the most valuable currency that central banks can offer, securing that trust is imperative. By adopting quantum-safe encryption today, we help to ensure that the backbone of our financial systems remains safe and trustworthy, even as cybersecurity technology advances. The quantum future is uncertain, but with proactive collaboration and innovation, we can be certain that trust in the financial system remains intact.

Want to learn more about how Juniper® Beyond Labs is working with an ecosystem of partners to develop crypto-agile, quantum-safe VPN solutions that include a broad portfolio of quantum-safe key solutions? Visit us at https://www.juniper.net/us/en/company/juniper-innovations/beyond-labs.html.