In any business, the pricing strategy requires a deep analysis of multiple variables: the perceived value by the customer, the business model, the business costs, product differentiation, the competition (and substitute products), local market forces and the stage of the market.

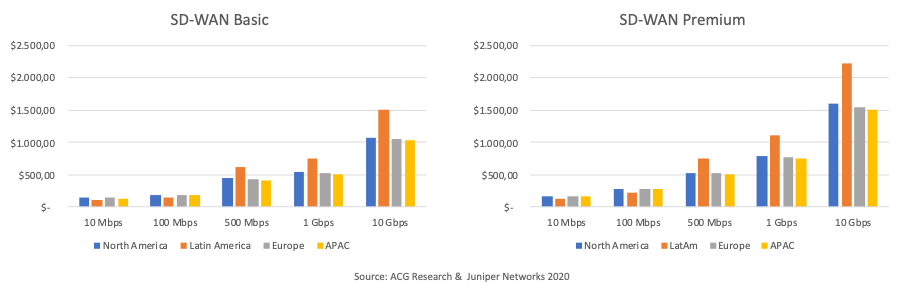

Many service providers worldwide are offering or planning to offer SD-WAN services. The features and pricing structures for SD-WAN services vary among service providers and regions. Did you know that service providers can charge as much as 2.7 times more for the same SD-WAN managed service (connectivity excluded) depending on the region?

In collaboration with Juniper Networks, ACG Research has studied the global managed SD-WAN market to benchmark how SD-WAN services are priced. The resulting report is a great guide for SPs to price their common SD-WAN services competitively and also includes a calculator to model pricing and margin scenarios for more sophisticated services.

To effectively set pricing, service providers should consider the following questions:

- What is the perceived value by the end user? Does it change by vertical?

- What is the business model? Aggressive market growth? Risk of cannibalization?

- What are the costs of running a managed SD-WAN service?

- Can the SP offer differentiation with their SD-WAN service? Some look at bundling with wireline or LTE connectivity, cloud/hosting services, etc.

- Who is the competition and what do they offer? What are the substitute options for Enterprises (MPLS, hybrid WAN, IPSec VPN)

- What is the SD-WAN awareness in the market? Are the enterprises ready?

Cost-Based Pricing versus Value-Based Pricing

For many years, enterprise networks have been based on MPLS IP-VPN and enterprises have paid a premium for the value received. Over time, with applications moving to the cloud and the growth of good-enough internet connections, the perceived value of MPLS VPNs by enterprises has decreased. With an undifferentiated service and lower perceived value, MPLS VPN becomes a commodity and the pricing model moves from value-based to cost-based pricing, where SPs are looking to keep the customer at the cost of losing margin.

Despite the amount of competition, SD-WAN services are relatively new, with low penetration rates and provided with multiple features to build a differentiated value proposition to individual customers and verticals. A value-based pricing strategy can certainly help SPs to monetize this space.

Global Pricing Strategy for SD-WAN Services

Globally, SD-WAN services are becoming increasingly popular. The worldwide market for SD-WAN is $1.8 billion in 2020 and is expected to reach $2.9 billion in 2023. SD-WAN penetration rates are 53.5% in the Americas, 22% in EMEA and 3.1% in APAC. Global penetration rates remain low at 6%.

ACG Research and Juniper Networks have collaborated in a research and modelling project on service provider SD-WAN pricing. Our Global Pricing Strategies for SD-WAN Services white paper provides valuable insights on how service providers are pricing SD-WAN services and also provides average SP SD-WAN pricing by region.

The diagram below illustrates the average monthly price per site for a basic SD-WAN service vs. a premium SD-WAN service; including the CPE rental cost but excluding the connectivity cost.

This data provides a framework for service providers to design and price their SD-WAN services based on benchmark pricing. With this information, SPs can compare pricing for multiple options and review the information they need to analyze up-sell opportunities and align the required investments to offer those services.

The document includes regional average pricing information for SD-WAN with basic security, SD-WAN with premium security, as well as optional add-ons such as on-premise VNFs, LTE backup, HA CPE and installation costs. We hope this data helps many service providers monetize managed SD-WAN services as a new revenue stream.