Based on Analysys Mason’s survey of CSPs, Enterprises and Cloud Providers to understand the key motivations and challenges of the DIY approach, overall DC automation strategies and benchmark automation across key operational processes. This is the second of a three-part blog series that summarizes the results for the Cloud Provider segment. Read parts one and two.

Cloud providers, even small and midsize ones, tend to stay a step ahead of other industries in adopting new technology. You can understand why: when customers are measuring you against hyperscale giants like Amazon, Microsoft and Google, you better be able to move quickly to deliver seamless user experiences. When Analysys Mason conducted a far-reaching survey of the state of data center network automation, cloud providers showed more significant commitment and progress than other types of business. Nevertheless, the study found much room for improvement.

Even cloud providers seeing the notable benefits from automation must invest massive time and resources to support it—far more, on average, than Enterprises or Communication Service Providers (CSPs). Why haven’t these automation initiatives translated to lower Operational Expenses (OpEx)? Because cloud providers also lead all industries in relying on custom Do It Yourself (DIY) automation software. Let’s review why data center network automation remains so resource intensive and what Analysys Mason recommends cloud providers do to gain more value from these efforts.

Inside the Numbers

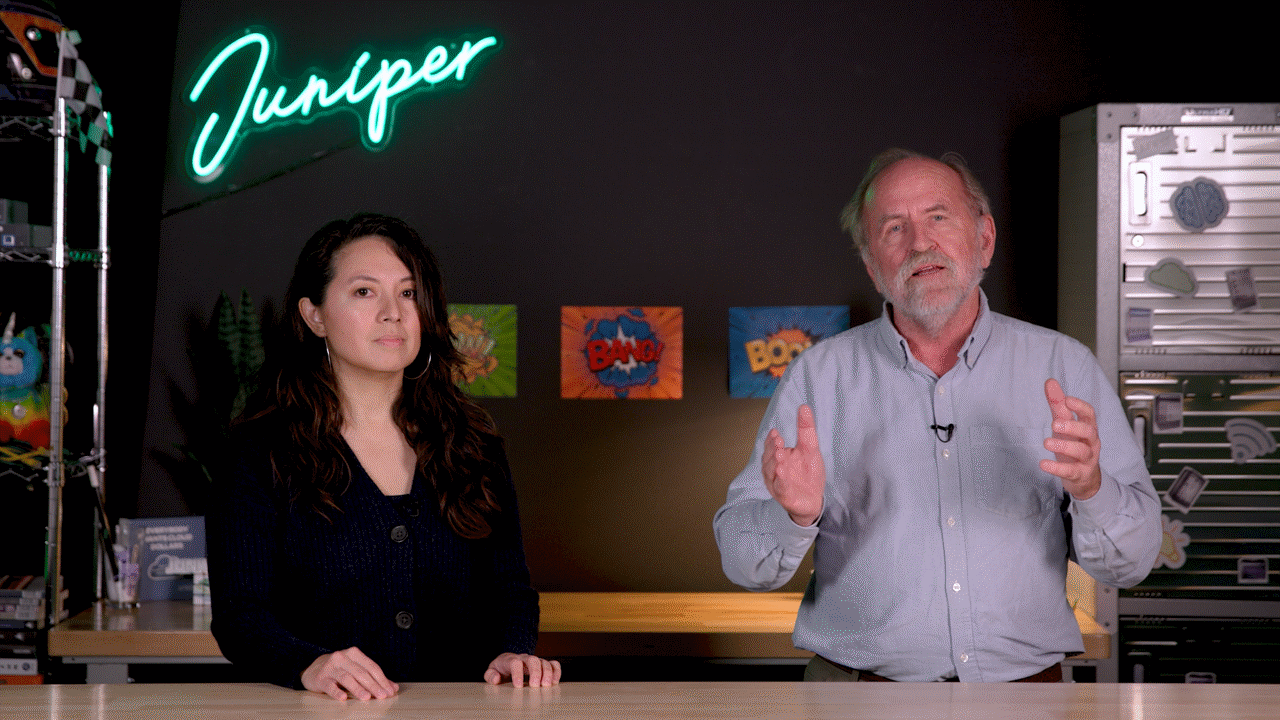

To capture the state of data center network automation, Analysys Mason surveyed 29 cloud providers in markets worldwide (Figure 1). Respondents ranged from organizations with less than 20 data centers to those with more than 100, though generally were small or midsize players under $1 billion in revenues (i.e., they represented more regionally focused providers offering solutions like private cloud hosting or colocation services rather than hyperscale public clouds).

Figure 1. Profile of cloud providers surveyed.

Among the survey’s biggest takeaways:

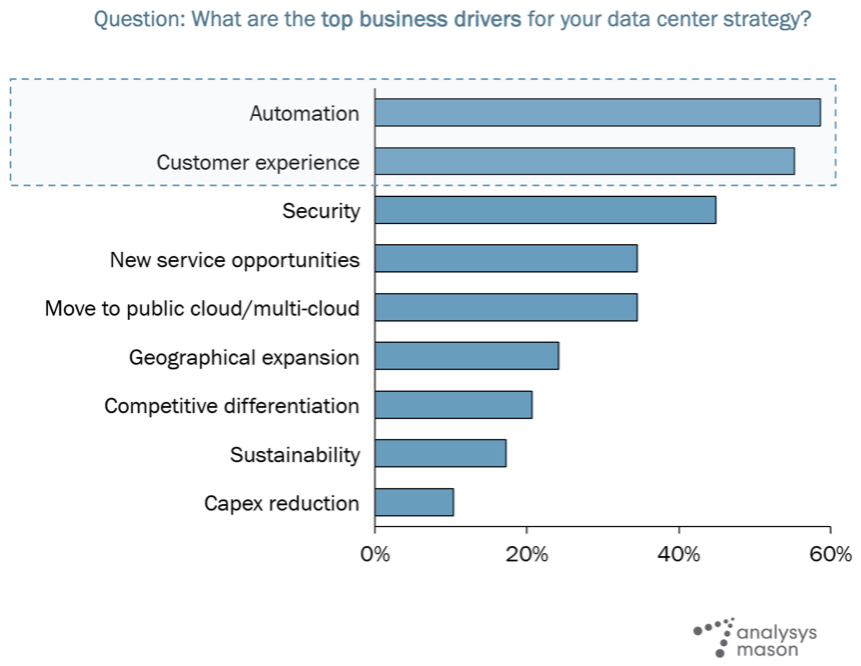

- Cloud providers are committed to automation but have work to do. Cloud providers are the most automated among all segments (having automated 44% of their data center networking operations, on average), but still lag well behind hyperscalers like Amazon or Microsoft. Analysys Mason believes this gap could pose a significant risk to these providers’ competitiveness and longevity.

- They prioritize agility and customer experience. Midsize cloud providers aren’t looking to compete directly with the hyperscalers but want to prevent them from overtaking their business and absorbing their customers. Knowing they can’t match the economies of scale of companies like Google or Amazon, respondents believe automation will help them become more agile while providing comparable customer experiences.

- They rely heavily on DIY automation. Cloud providers lead all segments in dependence on in-house, custom-developed network automation software using a variety of DIY tools. To support these efforts, they typically maintain large, dedicated developer teams.

- They’re achieving positive outcomes—but not easily or efficiently. The most automated cloud providers perform key tasks much faster than less automated peers. Yet because they require many additional resources to build and maintain DIY software, automation hasn’t translated to smaller teams or lower OpEx. In fact, dependence on custom development leaves these companies continually struggling to find skilled resources.

Automation Drivers and Challenges

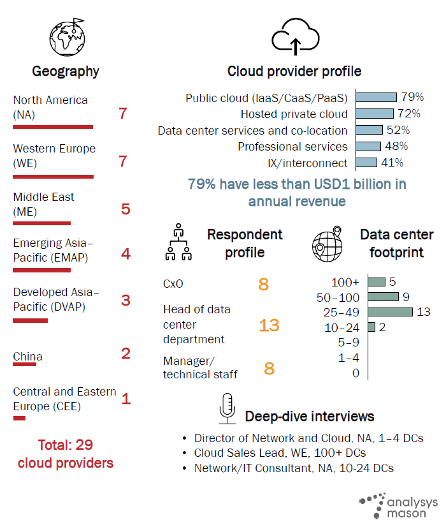

The data center leaders surveyed by Analysys Mason are well aware of their challenge in defending their market against larger hyperscalers. “The pandemic extended the lifespan of small cloud providers by a few years. If they don’t switch very quickly to automation and SDN, they will not survive in this highly competitive market,” said Network/IT consultant for a Cloud Provider from North America. Indeed, they believe enabling more programmable and on-demand customer experiences is central to their long-term success (Figure 2), reflected by their investments in automation.

Figure 2. Business drivers for cloud providers’ business strategy.

Figure 2. Business drivers for cloud providers’ business strategy.

Cloud providers are the most advanced of all segments Analysys Mason surveyed, having automated 44% of Day 0, Day 1 and Day 2 operations on average (Figure 3). Yet the survey revealed significant gaps between the most and least automated providers.

Figure 3. Level of automation across segments and among cloud providers.

Figure 3. Level of automation across segments and among cloud providers.

What, specifically, do cloud providers want to automate? The most significant pain point is multivendor integration and support. To avoid vendor lock-ins, cloud providers source equipment from multiple vendors ending up with highly heterogeneous environments that are difficult and expensive to manage. That’s especially true among colocation providers and others managing multiple customized customer environments, which tend to be the least automated.

Other pain points include:

- Complex network design and implementation: Day 0 and Day 1 operational tasks pose the biggest challenges for cloud providers. 70% say they struggle with data center design, with the largest (50 or more data centers) overwhelmingly naming this their top operational challenge.

- Scarcity of skilled developers: Cloud providers of all sizes said that finding people with the right skills and expertise to support their multivendor data center fabric is a huge challenge—and a massive barrier to automation.

Despite the diversity of providers surveyed, respondents cited the same persistent problem: Whatever advantages they realize from automation, heavy reliance on DIY tools creates significant challenges.

DIY Costs and Complexity

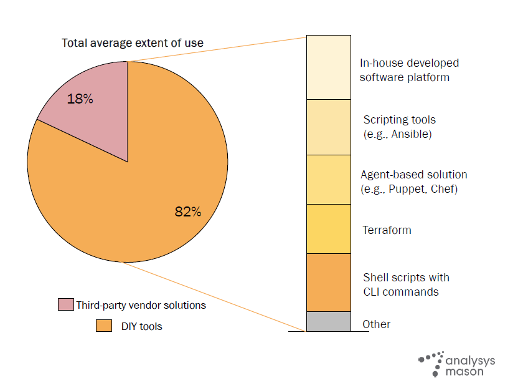

Cloud providers overwhelmingly use in-house developed software and tools when automating their data center fabrics. Respondents say 82% of their automated Day 0, Day 1 and Day 2 operations rely on DIY software (Figure 4),the highest of all segments.

Figure 4. Mix of DIY and third-party automation tools.

Figure 4. Mix of DIY and third-party automation tools.

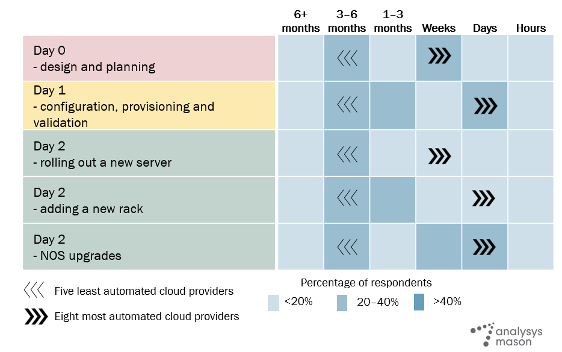

Why do these organizations focus so heavily on DIY automation? Because in-house development is ingrained in their culture. Cloud provider leaders see their ability to deliver customized services as key to maintaining an edge against competitors. And indeed, the more automated cloud providers can carry out operational tasks far more quickly. Highly automated cloud providers can perform some tasks in hours that take days or weeks for their less automated peers (Figure 5).

Figure 5. Time required for key network operations tasks.

Figure 5. Time required for key network operations tasks.

Yet relying on DIY automation carries high costs. Cloud providers must staff large, dedicated teams (sometimes 20+ developers) to utterly support and maintain their custom automation software. This makes finding skilled people a constant challenge. It also makes it much harder to translate automated operations into OpEx reductions and Return on Investment (ROI).

Cloud providers devote a substantial budget to maintaining DIY software (sometimes more than half of the entire data center budget). Even after these investments, many report they still haven’t achieved “true” zero-touch automation and continue relying heavily on manual coding. Up to 75% of cloud provider network engineers write or adjust scripts daily or weekly.

Rethinking Automation: 10,000 Devices Under Management

Cloud providers have made impressive progress in automating their data center networks. But with so many still struggling to achieve scalable, cost-effective operations, Analysys Mason believes it’s time to reassess automation strategies, particularly the role of DIY software. By shifting some operational processes to third-party, out-of-the-box automation solutions, cloud providers could redeploy skilled developers to other areas where they could make more strategic contributions to the business. Juniper Networks can help them do it.

Juniper Apstra provides a proven, intent-based platform to enable repeatable, reliable network automation, even in complex multivendor environments. Worldwide, there are now more than 10,000 network devices under Apstra management. With developer-friendly Software Development Kits (SDKs) and Application Programming Interfaces (APIs), cloud providers can seamlessly integrate Apstra with existing DIY tools and workflows, reduce OpEx and improve ROI.