Based on Analysys Mason‘s survey of CSPs, Enterprise, and Cloud Providers to understand the key motivations and challenges of the DIY approach, overall DC automation strategies and benchmark automation across key operational processes. This is the second of a three-part blog series that summarizes the results for the Enterprise segment. Read part one.

Analysys Mason recently shared the survey results on the state of data center network automation among Communication Service Providers (CSP). Analysys Mason found that, while telecom operators continue to automate, a reliance on in-house tools and development continues to undermine their automation efforts. But does the same hold true for enterprises?

Analysys Mason also conducted an exhaustive survey of enterprises to capture a broader picture of the state of data center network automation. They found that enterprises on every continent, in every industry, are indeed investing in automation. Yet even when they see real value from these efforts, most enterprises continue to suffer from the same issues plaguing telecoms in their approach. Too often, enterprises rely on in-house built tools and custom scripting as the centerpiece of automation initiatives—and fail to achieve the full benefits they had hoped to accomplish. The goal of automation should be to mask underlying complexity, not create more of it. The study revealed that although automation makes enterprises quicker and more agile, maintaining homegrown software and scripts takes up considerable resources, eroding the return on automation investments.

What can businesses learn from network automation efforts across different regions and industries? And what can enterprises do to put themselves in the best position for success? Let’s take a closer look.

Crunching the Numbers

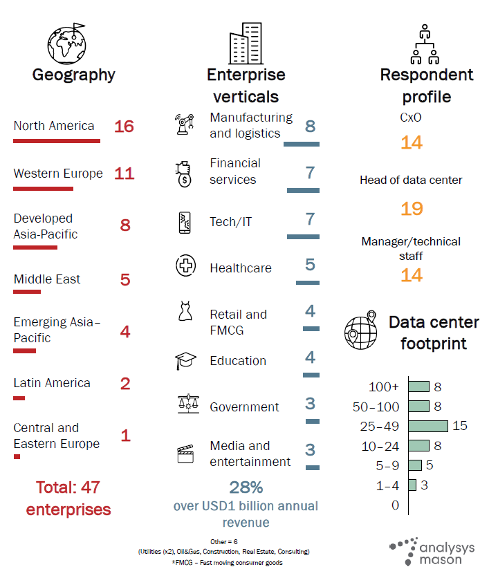

To capture a detailed picture of data center network automation, Analysys Mason surveyed 47 enterprises of different sizes across different geographies, representing eight distinct vertical industries (Figure 1). As you would expect from such a diverse group, responses spanned a wide range of automation initiatives and outcomes. Nevertheless, several clear trends emerged:

- The overall level of automation among enterprises remains low. Currently, enterprises have automated just 37% of their data center network operations on average (although the study found significant variation within verticals).

- The most automated enterprises are far more operationally efficient than their less automated peers. This finding suggests a strong business case for network automation—though the benefits tend to be more strategic (improving speed and agility) than narrowly financial (such as reducing Operating Expenses (OpEx)).

- Overall, enterprises still have a long way to go. Even in the most automated organizations, data center network operations are still nowhere near true “zero touch.” They typically require significant manual input and interventions, preventing businesses from gaining more substantial efficiencies and cost reductions.

Figure 1: Profile of Enterprises Surveyed

One factor that stood out across the board: most enterprises rely heavily on in-house developed automation tools. Regardless of size, industry or level of automation, this dependence on do-it-yourself (DIY) tools instead of commercial third-party platforms creates significant obstacles. Even when automation makes enterprises quicker and more agile, maintaining homegrown software and scripts takes up considerable resources, eroding the return on automation investments.

Automation Drivers and Challenges

Overall, the most significant drivers for the enterprise data center strategy were improving customer experience and enhancing security. Enterprise leaders view data center network automation as closely interlinked with those goals. Unlike CSPs (who typically seek to lower OpEx and reduce reliance on specialized staff), enterprises are generally motivated by a desire to improve technical and operational capabilities. Additionally, where CSPs tend to focus on Day 2+ operations, enterprises split their automation investments more evenly on average across Day 0, Day 1 and Day 2. In fact, most enterprises cited the data center design, operational complexity and lack of skilled resources as their biggest pain point.

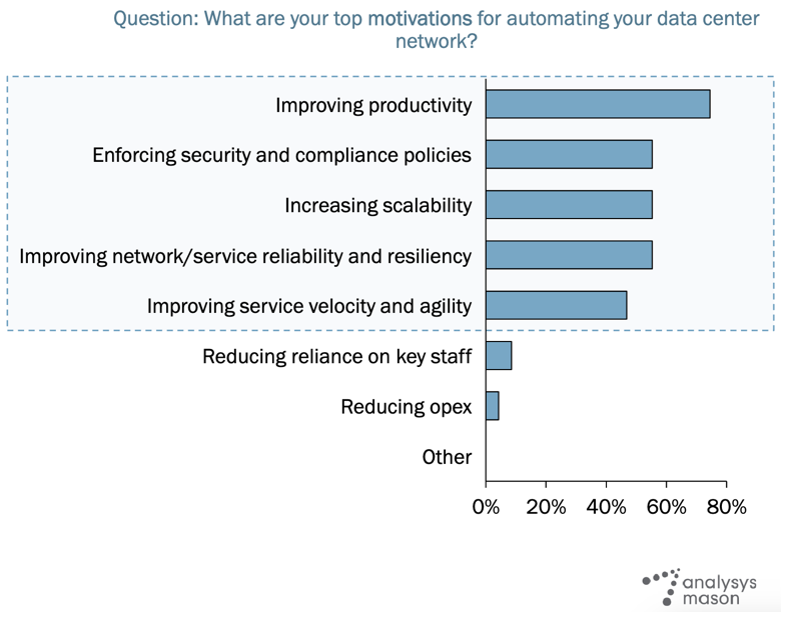

In ranking goals for data center network automation initiatives, 74% of enterprises put improving productivity at the top of the list. This makes sense, as most enterprises see their data centers as a strategic asset, viewing automation as a way to gain a competitive edge. The details, however, differ by region. Enterprises in developing markets are investing in automation to make their data center networks and services more reliable, while those in more developed regions are motivated by improving operational efficiencies. “We have a 5-year plan for becoming cloud-native and data center networks are a key part of this plan. We want to automate as much as possible for deployment velocity, reduced delivery times and fewer incidents,” said the CTO of an Insurance company from Western Europe.

Figure 2: Motivations for Data Center Automation Across Enterprises

Figure 2: Motivations for Data Center Automation Across Enterprises

While the survey found similar overall levels of automation across enterprise verticals, there was significant variation within industry verticals. In some industries, the most automated enterprises had achieved about 40% more automation, on average, than the least automated ones. Yet no particular industry showed a significant edge, suggesting that automation success really depends on the individual business.

The Biggest Challenge: Maintaining DIY Automation

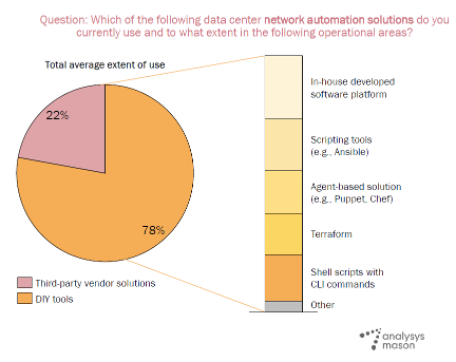

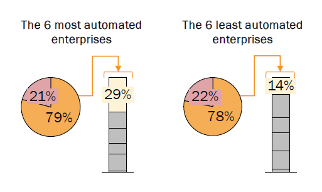

Across all industries and verticals, respondents cited a common pain point: they were spending far too much time and resources maintaining DIY automation software. These problems persisted regardless of the progress an enterprise made in automating data center network operations. For both the most and least automated enterprises, nearly 80%of automation is based on DIY tools (Figure 3).

Figure 3: Mix of Network Automation Approaches

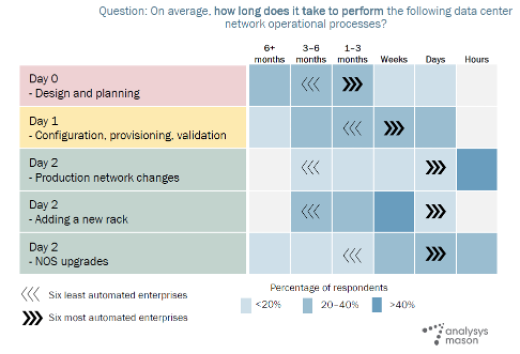

The most automated enterprises did see significant benefits. While they maintained about the same headcount as less automated peers, they could accomplish much more quickly with those resources. On average, these organizations needed just a few days to perform key Day 2+ operational tasks that took the least automated enterprises several months (Figure 4).

Figure 4: Comparing Time to Perform Operational Tasks

Figure 4: Comparing Time to Perform Operational Tasks

Despite these benefits, however, the need to build and maintain DIY toolsets creates significant operational overhead, regardless of how much automation progress an organization has made. Finding skilled staff to develop and maintain custom automation is a massive challenge for the least automated enterprises. Even the most automated, however, report that DIY automation adds significant operational complexity. In fact, most automated enterprises devote more of their budgets (50% on average) to supporting DIY automation. They also typically require a dedicated team (20+ staff), more than half of whom write scripts on a daily or weekly basis.

Unsurprisingly, this massive DIY effort makes generating OpEx savings from data center network automation extremely difficult despite other important benefits these efforts achieve. As a result, very few enterprises say they are fully satisfied with their DIY automation, and most are currently looking for improvements. A full 66%—including five of the six least automated enterprises and four of the six most automated—say that, if they could start over, they would choose a third-party vendor solution instead.

Building Better Automation – 10,000 Devices Under Management

What should we take away from this study? The overall state of data center network automation among enterprises is… mixed. While automation delivers a clear competitive advantage, the DIY approach that most enterprises employ creates as many new operational challenges as it solves. Fortunately, there is a better alternative.

By choosing multivendor, intent-based, third-party automation solutions like Juniper Apstra, enterprises can realize the strategic advantages of data center network automation without the DIY headaches. They can use reference designs and templates to enable true zero touch operations, even in the most complex environments, and they can build a more efficient and cost-effective data center network organization, even as they get faster and more agile. Worldwide, there are now more than 10,000 network devices under Apstra management.

To learn more about how enterprises are automating their data center networks and the steps Analysys Mason experts think they should take moving forward, download the full report now.