Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality.

Juniper believes that domestic and international tax laws should recognize the global nature of today’s economy. For nations to attract business, grow jobs and foster economic growth, governments should ensure that their tax regimes encourage, instead of discouraging, investment. Today, too many nations focus on the instant collection of revenue instead of how their tax policies can benefit their citizens and investors.

That said – let’s talk taxes. Juniper Networks is aware of a July 2021 report issued by the Institute for Taxation and Economic Policy (ITEP) entitled ‘Corporate Tax Avoidance Under the Tax Cuts and Jobs Act’ that asserts that Juniper is among a group of corporations that was profitable in the 2018-2020 periods, but, cumulatively, did not pay any federal income taxes during that period. Juniper believes that we have a responsibility to pay our taxes, and as further detailed below, Juniper has paid a significant amount of taxes on a worldwide basis, including federal income taxes during that period. We want to set the record straight – the assertion in the ITEP report that Juniper did not pay federal income taxes during that period is false.

After a careful review of the ITEP report, there are demonstrable errors in that the report’s analysis fails to consider US Generally Accepted Accounting Principles (GAAP) and, more specifically, it does not account for certain non-cash items which were fully disclosed in Juniper’s public SEC filings and required to be reflected in current tax expense under GAAP. Additionally, we contacted ITEP to discuss the report and to request a retraction, but we have not yet received a response to date.

To add, limited, yet straight-forward, due diligence of Juniper’s publicly filed financial statements, including the Statement of Consolidated Cash Flows for the year ended December 31, 2020, clearly rebuts the ITEP report.

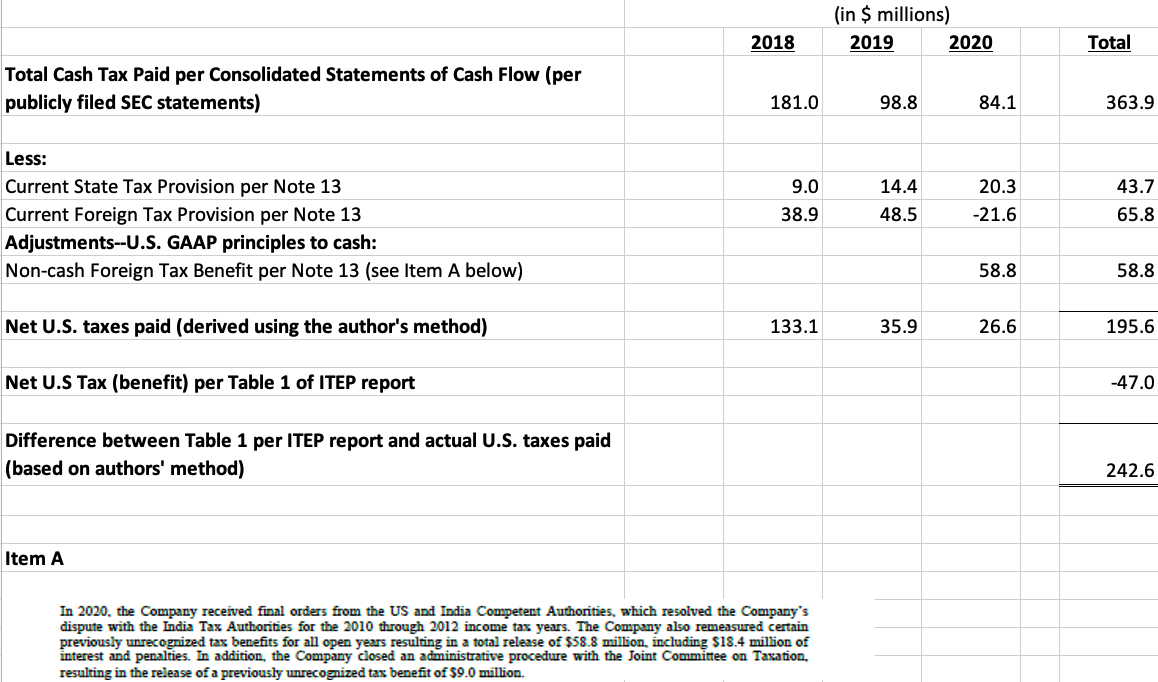

As the table below indicates, Juniper paid cumulative worldwide income taxes of $363.9 million for the periods 2018-2020. If we accept ITEP’s apparent presumption that current state and foreign taxes represent actual cash taxes paid, the table shows that $195.6 million of the total $363.9 million in worldwide taxes that Juniper paid would be designated as US Federal income tax. This is in direct contradiction to ITEP’s assertion that Juniper received a federal income tax benefit of $47 million over the same period.

The $195 million referenced in the table is materially consistent with amounts reported and filed, or expected to be filed, with the U.S. Treasury Department.

In summary, Juniper believes it is our responsibility as a corporate citizen to pay our fair share of taxes, including corporate income taxes, employment taxes, social contributions, property taxes, import and customs duties and indirect taxes. We understand that the President has made certain corporate tax proposals, and we’ll continue to monitor the progress of the proposed legislation as Congress addresses those provisions.