Data center networks built from the Juniper portfolio cost less. We’ve created countless financial models for customers considering Juniper vs. other vendors. Certainly, Juniper doesn’t always win these business cases, but we usually win, and this blog will demonstrate why.

To get a rough idea of the savings opportunity, spend a couple of minutes playing around with our online data center TCO calculator. This will give you just a small taste of what Juniper can do for you. For the full immersion, tell your Juniper account team that you want a customized financial model for your data center environment. There’s no better way to understand the operations and the economics of your data center than to build a detailed financial model of it. Best of all, we’ll build the model for you and then we’ll take you through it, bringing our years of experience working with hundreds of customers.Let’s walk through each of the elements that determine the cost of your data center network.

CapEx

We can break down a data center operator’s costs into two categories: CapEx and OpEx. The CapEx side is pretty simple. For our customers it’s the upfront cost (i.e. price) of buying a switch and any software needed to manage the switches and the overall fabric. (Perpetual licenses are generally considered CapEx, while subscription licenses are considered OpEx – Juniper offers both.) The truth is that a lot of the switching hardware from different vendors is similar in functionality. The engineering and operations teams make the final vendor selection then pass it to the procurement department who beats up the vendor until they get the best discount.

However, Juniper does have an advantage when it comes to hardware because, unlike our competitors, we have a strategy of silicon diversity. Our comprehensive portfolio of switches and routers is based on silicon from Broadcom, but we also design our own ASICs. Our PTX line, based on Juniper Express silicon, is found in many data centers around the world. Our MX line, which is based on Juniper Trio silicon, is a workhorse for service provider wide area networks (WANs). But MX is used in plenty of data centers, particularly in data center interconnect (DCI) use cases. Our EX line of switches, which also uses custom Juniper silicon, skews toward campus and branch environments, but can also be found in many data centers around the world. Finally, the Juniper QFX portfolio is based on silicon from Broadcom.

Most of our competitors either rely entirely on Broadcom or entirely on their own custom silicon. Juniper’s commitment to silicon diversity means flexibility for our customers, both at a strategic level (additional supply chain alternatives) and a tactical level (a comprehensive set of use cases can be addressed with a broader portfolio of ASICs).

Juniper’s primary differentiation for data center networking is in our software, which consists of on-box software—Junos® OS—and off-box software—Juniper® Apstra®, our data center fabric management and automation solution. Specifically, the value of the software is due to the operational savings it provides customers. More on that later.

OpEx

Determining OpEx, essentially the recurring costs, is a little more involved than CapEx calculations. And let’s be clear, the cost to operate a data center is much more expensive than the initial cost to buy the data center infrastructure. If you aren’t thinking hard about simplifying ongoing operations before deploying new data center equipment, then you could be in for trouble.

First let’s look at the OpEx associated specifically with the hardware: power, space, and cooling. A switch needs space, it draws power, and it also requires additional power for cooling so the electronics don’t overheat. Support/maintenance is another element of OpEx, but we generally exclude this from our analysis since we find support costs from different vendors to be very similar.

The space calculation is fairly simple. We use average data center real estate costs, expressed in dollars (or Euros, etc.) per square foot (or meter). Port and bandwidth density of a switch is what customers should look for here—this is what determines the space used up by a switch. Vendors like Juniper with high “platform velocity”—that is, keeping up with the latest merchant and customer silicon—excel at port density, and therefore use up less real estate. Vendors who don’t keep up with that hamster wheel of hardware platform innovation will end up costing you more space.

Sustainability – going green pays

Saving the planet often means savings costs too. The direct power consumption calculation for a switch is straightforward. Look at the hardware datasheet for power draw in Watts (W). When comparing vendors make sure you’re comparing apples-to-apples. Read the fine print. Vendors can indicate power numbers in different ways. The power draw from different vendor switches that use the same silicon should be about the same—if they appear meaningfully different then I’d question the integrity of the datasheets because the underlying ASIC ultimately drives the power consumption of any router or switch.

In addition to the direct power required to keep the switch running, to capture the full expense of operating the switch you must also include the power required to cool the switch. The Power Usage Effectiveness (PUE) is a critical metric used to assess the energy efficiency of data centers. It is defined as the ratio of total facility energy consumption to the energy consumed by IT equipment: PUE = [Total Facility Energy] / [IT Equipment Energy].

PUEs for older data centers are generally above 1.5. Newer, state-of-the-art data centers have PUEs approaching 1.3. A PUE of 1 is the theoretical maximum so we will continue to gradually approach that point as new data centers break ground. To be clear, a PUE of 1.5 means that the customer needs an additional 50% power to cool the switch (and other power for the data center, such as lighting). Power is quickly becoming a design constraint with large, new AI training clusters. Innovative techniques, such as liquid cooling, will continue to push PUE numbers down.

Carbon emissions are a direct by-product of the power consumed. Most of our customers now prioritize their carbon footprint. Many countries administer carbon emissions trading programs—this an additional source of costs (buying carbon credits), but it also can be an additional source of revenue (selling carbon credits) for data center operators.

The primary savings opportunity—automating workflows

The real opportunity for business transformation lies in radically altering the OpEx associated with the labor and time required to design, deploy, and operate your data center networking infrastructure. Let’s start with a basic truth: all automation discussions should begin with a (relatively mundane) discussion about process, because this is what you’re automating. If your workflows are inefficient then automation is just going to magnify the inefficiency. Think like a hyperscaler: simplify and standardize your architectures, then simplify your processes before you start to think about automation.

Some of our customers have a detailed understanding all the workflows involved in designing, deploying, and operating their data centers, but most do not. An even smaller number of customers knows exactly how much time they spend on each process. We can help customers better understand the entire data center lifecycle, from Day 0 design and planning, to Day 1 deployment, through Day 2+ and ongoing operations. The simple act of sitting down with Juniper and going through their data center lifecycle in detail is illuminating for most of our customers.

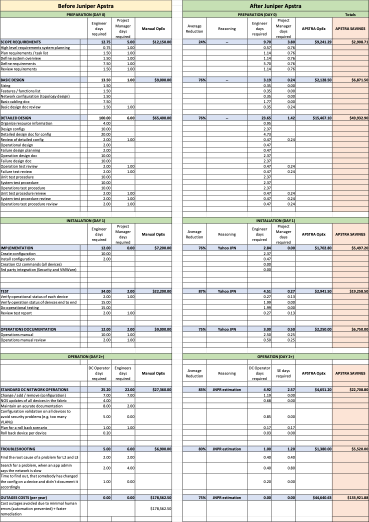

Our not-so-secret weapon to dramatically save time and effort is Apstra, Juniper’s data center fabric management and automation software. Our business analysis team compares the time you spend before and after Juniper Apstra for dozens of processes. For your current situation (before Juniper Apstra) you either tell us how much time you spend on each step, or we can help you estimate it based on our experiences with other customers. The projected labor times (after Juniper Apstra) are based on what our typical customers experience.

Beyond total cost of ownership

The true business case for using Juniper for your data center network goes far beyond just the cost considerations detailed above. If we’re focused only on the goal of operational efficiencies and person-hours reductions, then we’re thinking too narrowly. The bigger case for change entails growing more efficiently and supporting business objectives to build top-line growth.

Substantial benefits accrue to our customers that we often can’t specifically quantify but which can be even more important, including:

- Opportunity cost savings: To make the network engineering job better, start by reducing the toil, freeing people up to work on things that are more important and more interesting. This freed up time could be a catalyst to drive new strategic projects that deliver substantial value for the company.

This isn’t a race to the bottom, eliminating human beings from the value chain. If someone on my team told me they had found a way to automate their job I wouldn’t fire them, I’d give them a raise. And then I’d ask them to find something else to automate. As the economist Richard Baldwin said, “AI won’t take your job. It’s somebody using AI that will take your job.”

- Multivendor flexibility:Juniper Apstra continues to be the only multivendor intent-based networking game in town. This is such a powerful capability on so many levels. Maintain two switch suppliers for strategic flexibility, supply chain diversity, and negotiation power (see above about beating up your vendor for a discount). Managing multiple vendors with one tool also reduces training costs and complexity. The extent of the benefits of multivendor is vast, but again, tough to quantify.

- Improved reliability and speed: The by-products of reliability are speed and efficiency. If organizations know the data center will work every time without fail, then they can move quickly and without the organizational overhead. It’s counterintuitive, but by not focusing on speed, they get faster. By not focusing on efficiency, they streamline operations. Speed means quicker time to value for any project.

Don’t leave money on the table

If you aren’t shortlisting Juniper in the data center, you are likely leaving money—and capability—on the table. But don’t take only our word for it. Check out this report from Forrester Research that shows how you can save with Juniper Apstra and spend a couple minutes playing around with our online data center TCO calculator to get an idea of the savings opportunity. And to really get a complete understanding of the economics of your data center, tell your Juniper account team that you want a customized financial model built for your data center environment.

There is no better way to understand the economics of your business than to build a financial model of it. We’ll do the work for you and take you through it line by line. We can’t assure you that the Juniper numbers will always come out on top, but we can assure you that you’ll walk away from that conversation with a better understanding of the detailed processes and workflows involved in operating your data center and your business overall.