Based on Analysys Mason’s survey of CSPs, Enterprises and Cloud Providers to understand the key motivations and challenges of the DIY approach, overall DC automation strategies and benchmark automation across key operational processes. This is the first of a three-part blog series that summarizes the results for CSPs.

Not long ago, Communication Service Providers (CSPs) treated data center network automation as a nice-to-have aspiration. Today, operators of large-scale telecom environments need no convincing. With revenues flat and data center fabrics growing more complex, automation is becoming the only way to keep operating expenses (OpEx) from eroding profitability. Even more important, automation is proving crucial to delivering the consistently excellent experience-first networking services that will make or break a CSPs’ future.

The good news is that more CSPs automate their data center network operations daily. However, not all automation strategies are created equal, and many just aren’t delivering the desired results. New research indicates that even when CSPs commit to automating their data center fabric, many take the “DIY” path—developing in-house scripts to patch together siloed vendor technologies and fragmented tools—and often fall far short of automation goals. In fact, 55% of CSPs relying on DIY automation say that they would choose third-party automation solutions if given the opportunity to do it all again.

Juniper Networks partnered with Analysys Mason to conduct an in-depth survey on the state of data center network automation (as a follow up to research the firm conducted last year) to get CSPs’ own perspectives on their progress. We wanted to learn what’s working, what’s not and what separates those seeing the most success in their automation efforts from those still struggling. The following are some of the key insights the study revealed.

Inside the Data

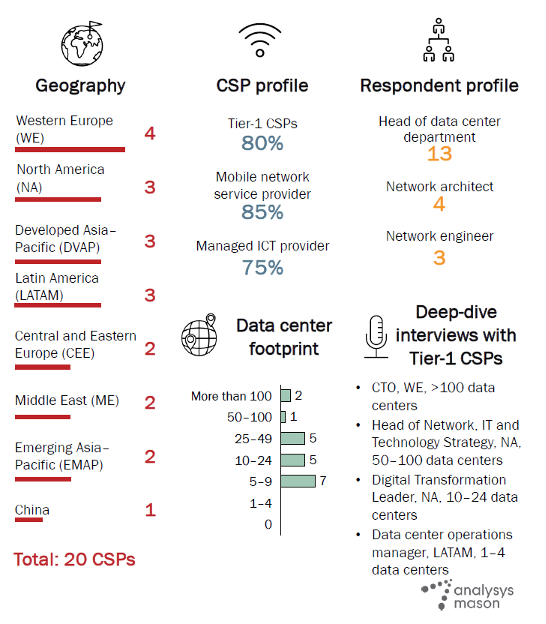

To take the pulse of CSP automation initiatives, Analysys Mason surveyed 20 telecommunications operators and conducted deep-dive interviews with senior decision-makers and data center network operations staff. They spoke with a diverse range of CSPs around the globe to capture the current state of the industry (Figure 1).

Among the top takeaways:

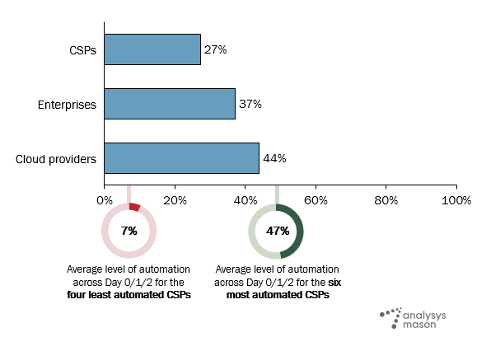

- Overall, automation progress remains slow. The study found that most CSPs continue to lag cloud providers and enterprises in automating their data center fabrics. On average, CSPs have automated just 27% of data center network operations across Day-0, Day-1 and Day-2 and beyond (Figure 2).

- Operational complexity remains pervasive. Nearly all CSPs surveyed (95%) cited the complexity of operating the data center network as a major problem. Survey respondents specifically pointed out the difficulty of patching siloed vendor technologies and fragmented automation tools.

-

- Automation strategies are evolving with data center ownership models. While it has been the go-to approach for the last few years, the DIY-first mindset seems to be waning. Many CSPs are rethinking network automation strategies as they increasingly partner with public cloud providers and adopt hybrid and multi-cloud data center solutions.

Perhaps the most important takeaway is that automation works—provided CSPs do it right. Analysys Mason found that those CSPs that had made the most progress in their automation journeys were far more operationally efficient than their less-automated peers, potentially presenting a strong business case for data center network automation. But when CSPs put aside complex, fragmented DIY tools and adopt more mature multivendor automation solutions, they can expect significant return on investment (ROI).

Overcoming Automation Challenges

Most CSPs investing in data center network automation prioritize Day-2+ operations. These tasks touch on customer experience, quality of service, SLA assurance and reliability, so they have the most direct effect on the business. However, they also tend to rely on data center environments that are increasingly fragmented and complex. As CSPs have added more IT solutions, vendors and management tools over the years, many find themselves operating what Analysys Mason calls “snowflake clouds” across their various networks and lines of business.

Each vendor often becomes its own silo, requiring specialized equipment, management tools and data models to operate. According to the survey, CSPs use more third-party vendor solutions to automate than cloud providers or enterprises. Unfortunately, many find that automating operations tasks across the multivendor fabric becomes more difficult as the number of vendor silos grows. This is where DIY efforts come in, as CSPs try to patch together proprietary technologies using custom scripts and in-house developed tools (accounting for 57% of current CSP data center network automation overall).

Relying on such cobbled-together solutions can’t produce efficient, scalable or repeatable automation. The DIY approach also leaves CSPs highly dependent on the individual engineers who coded those scripts (usually on top of other day-to-day tasks, leaving them frustrated and overworked). 75% of CSPs said they struggle with resource availability or dependencies on software engineers, creating a single point of failure for their fabric automation and the services depending on it.

Disappointing DIY Outcomes

The biggest problem with DIY automation is that it just doesn’t deliver the results CSPs hope to achieve. Analysys Mason compared CSPs relying most heavily on in-house automation with those using third-party solutions. On average, those going the DIY route:

- Struggle to generate an ROI from the effort they spend developing and maintaining DIY tools

- Dedicate a greater percentage of their data center budgets to automation

- Are less satisfied with the outcomes of their automation and are currently looking to improve or replace it

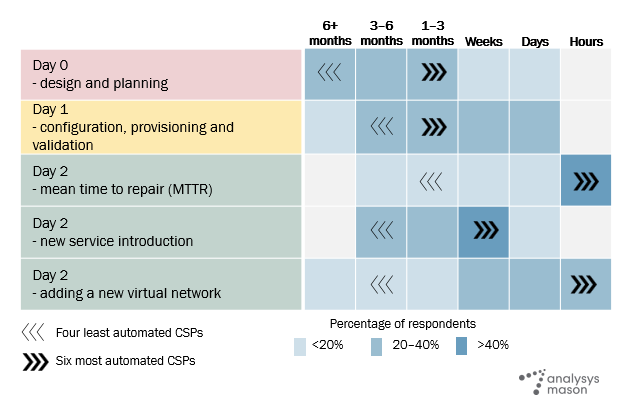

55% of CSPs relying on DIY automation say that they would choose third-party automation solutions if given the opportunity to do it all again. Compare that with the CSPs who have achieved the most progress in their automation efforts—most of whom choose third-party automation solutions over in-house tools, and overwhelmingly plan to continue. These operators are far more operationally efficient, carrying out complex operational procedures in hours that take months for their DIY peers (Figure 3). They also require fewer staff, averaging just 5-10 full-time employees for key network operations tasks, whereas less-automated DIY operators need 25-50.

Reimagining Automation: 10K Devices Under Apstra Management

The Analysys Mason survey suggests room for improvement even among the most automated CSPs. After all, data center networks are only growing more complex as operators shift to vendor-neutral facilities, managed services and hybrid clouds. Trying to keep pace with these changes is not viable by asking network engineers to tweak scripts continually and develop new custom tools. Fortunately, more CSPs now recognize that fact.

The operators seeing the most success in their automation efforts are taking a different approach. A vast majority would consider using third-party automation solutions like Juniper Apstra that are truly multivendor and intent-based. Instead of in-house development, they use reference designs and templates to achieve reliable, repeatable automation to keep pace with the business needs. Most importantly, they are proving that those investments pay off when CSPs stop applying band-aids to fragmented data center networks and employ mature multivendor automation. Worldwide, there are now more than 10,000 network devices under Apstra management.

For the full story and in-depth recommendations, download the Analysys Mason report here: